Professional Certificate Course in Recognizing and Managing Financial Risks

Completion Time

2 Weeks

Accreditation

3 CPD Hours

Level

Advanced

Start time

Anytime

About the course

The aim of the Recognizing and Managing Financial Risks course is to provide students with a comprehensive understanding of the different types of financial risks faced by banks and how to manage them effectively.

After the successful completion of the course, you will be able to learn about the following,

- Understanding Bank Capital.

- Identifying Commercial Bank Capital.

- Understanding Bank Regulatory Capital and its Classification.

- Types and functions of Bank Capital.

- Understanding Capital Requirements.

- Understanding Capital Adequacy Ratio: CAR.

- Basel Committee on Banking Supervision.

- Importance of Capital Adequacy Ratio to Shareholders.

- Understanding and calculating Risk-adjusted Capital Ratio.

- Standardization of Risk-Adjusted Capital Ratios.

- Key Trends in Bank’s Capital.

- Understanding Bank Balance Sheet.

- Structure of Bank’s Balance Sheet.

- Components of Bank’s Balance Sheet.

- Understanding Asset/Liability Management.

- Understanding Deposit Accounts.

- Types of Bank Deposit Products and Schemes.

Course details

The aim of the Recognizing and Managing Financial Risks course is to provide students with a comprehensive understanding of the financial risks that banks face and the tools and techniques used to manage these risks. By the end of the course, students should be able to identify and measure the different types of financial risks, and develop effective strategies to manage them through capital and liability management. Students will also develop skills in risk assessment and management that are relevant to careers in banking, finance, and related fields.

Module: Recognizing And Managing Financial Risks

Lecture: 1

Quiz: 1

The Recognizing and Managing Financial Risks course is centered on the supervision of bank capital and liabilities. Within this course, students will gain insights into various categories of financial risks encountered by banks, including credit risk, market risk, and liquidity risk. Moreover, they will acquire the knowledge needed to assess and handle these risks by implementing efficient strategies for capital and liability management. Upon completing the course, students should possess the capability to recognize pivotal financial risks and formulate plans to mitigate them.

-

Recognising Bank Capital and Liabilities Management

-

Recognizing and Managing Financial Risks

Accreditation

All of our courses are accredited by the relevant partners and awarding bodies. Please refer to our information in about us for more details.Entry requirement

There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course.The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience.

- Bank Analyst

- Risk Manager

- Financial Analyst

- Credit Analyst

- Investment Banker

- Asset and Liability Manager

- Portfolio Manager

- Internal Auditor

- Business Development Manager

- Treasury Manager

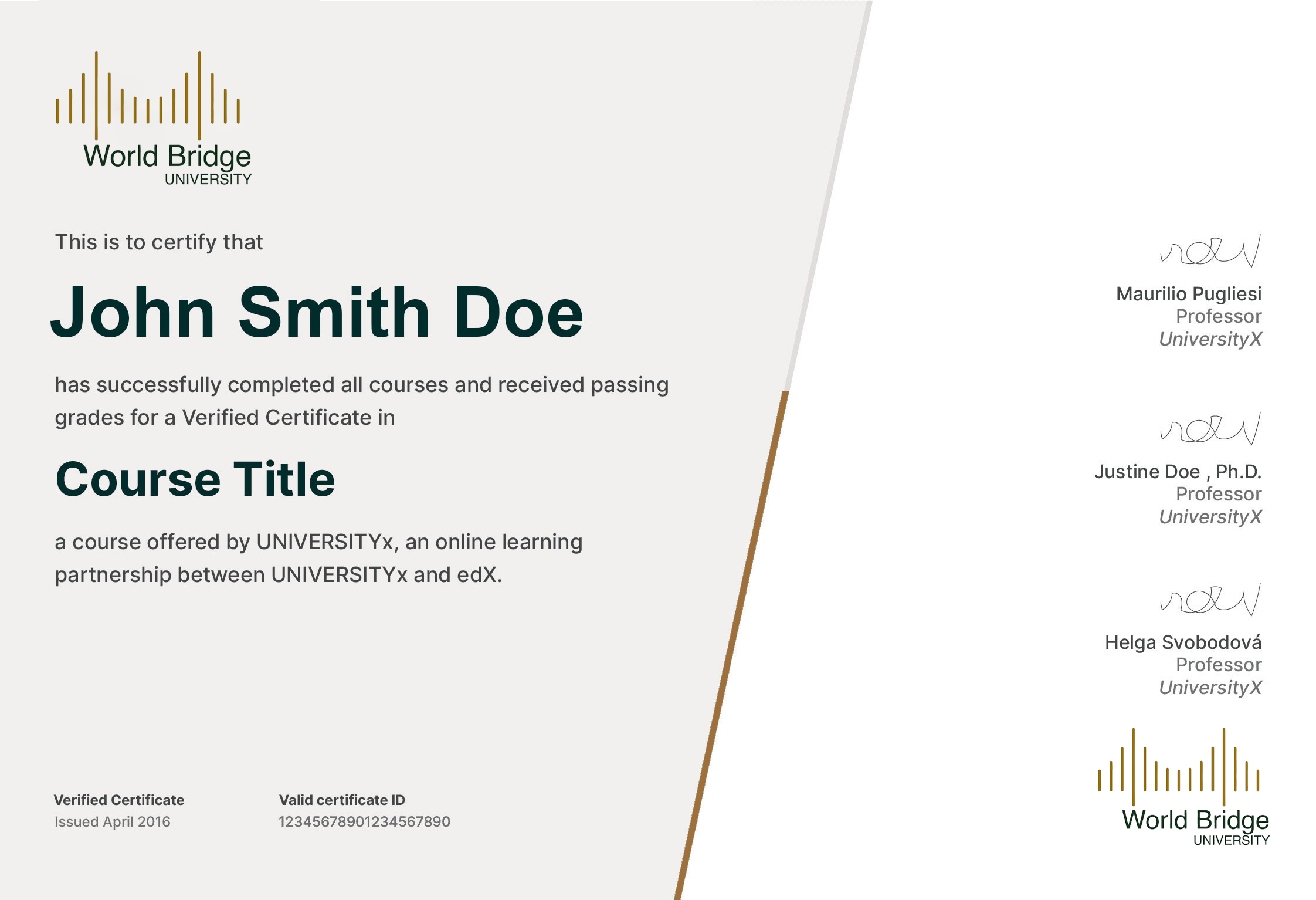

Sample Certificate

Empowering Your Path with Knowledge that Connects and Inspires

Find Programs Aligned with Purpose and Global Impact:

World Bridge University offers diverse, globally-focused programs designed to foster understanding and resilience in a rapidly changing world.

Learn Flexibly and Inclusively:

Our courses are accessible anywhere, enabling you to expand your mind and connect with others across borders at your own pace.

Earn a Credential that Reflects True Growth:

Achieve certification in programs that emphasize not only expertise but also empathy and cultural understanding.

Engage in Your Chosen Field with Purpose

Take the knowledge and skills you gain here to create positive change, building a future marked by inclusivity, sustainability, and collaboration.

How students similar to yourself are reaching their aspirations.

At World Bridge University, our students don’t just gain skills; they grow in empathy, connect across cultures, and shape a future grounded in inclusivity and collaboration.

Kim A.

Ghana

These short courses have been a game-changer for my career. The knowledge and skills I gained here helped me secure a promotion and a substantial pay raise. I'm grateful for the opportunity to learn from experts in the field.

Advanced Professional Certificate Courses

Hollie W.

Kenya

I can't recommend these courses enough! The content is well-structured, and the instructors are top-notch. I completed a course in project management, and it immediately boosted my confidence and job prospects.

Advanced Professional Certificate Courses

Omar A.

Pakistan

I was pleasantly surprised by how practical and hands-on the courses were. The skills I acquired here are directly applicable to my daily work, and I've become a more valuable asset to my company.

Professional Certificate Courses

Austin K.

Sweden

I initially had reservations about online learning, but these short courses completely changed my mind. The platform is user-friendly, and the support from the instructors is outstanding.

Professional Certificate Courses

Huzaifa A.

United Arab Emirates

These courses are a fantastic investment in your professional growth. The price is reasonable, and the knowledge gained is priceless. I now feel more confident and competitive in my industry.

Advanced Professional Certificate Courses

Jolene P.

United Kingdom

The selection of courses on this website is impressive. I've completed multiple courses, and they've all been incredibly enriching. I'm grateful for the opportunity to learn and grow.

Advanced Professional Certificate Courses