International Postgraduate Diploma in International Banking and Finance (Level 7)

Duration

9 Months

Pedagogy

Blended

Instalment

£ 1,284 /month interest-free*

Total tuition

£ 4,817

About the course

The International Postgraduate Diploma in Global Banking & Finance is designed to fit around work and personal commitments. World-class teaching is delivered via pre-recorded online lectures to enrich the learning experience. We have perfected the art of delivering financial management education. Our practice-based approach focuses on addressing real-world regulatory and application problems.

We don’t just give you the theory; we ensure you learn how to apply it in your working life immediately, with case studies, webinars, business simulations, and 100% project-based.

The International Postgraduate Diploma in Global Banking & Finance allows you to achieve the qualification between 8 to 10 months. It is a fast track to new opportunities and enhanced career prospects.

This programme aims to deliver a practical and realistic solution to many challenges in finance, such as compliance, standard reporting and auditing, which is supported by appropriate reference to theoretical and conceptual analysis in the related fields.

Course details

Mode of Study: Blended

Assessment: Research-based Assignments

The objective of the International Postgraduate Diploma in Global Banking & Finance qualification is to develop strategic financial management skills and an understanding of the regulatory environment in global banking for managers who have the authority and personal attributes to translate finance strategy into effective performance.

This qualification reflects current Global Banking & Finance practice and allows learners to develop and expand their high-level understanding of financial reporting, analysis and compliance.

Programme Structure and Credits:

This programme consists of 6 modules with a total of 120 credits.

Module: ASSIGNMENT & STUDY GUIDELINES

Lecture: 4

This module provides the most critical information about the study course and assignment submission.

-

VIDEO - How to Avoid Plagiarism in Your Writing

-

Harvard Referencing Style Guide

-

How to Summarise - Assignment Guide

-

Summarising, Paraphrasing, Quotation for your Assignment

Module: COMMERCIAL BANK MANAGEMENT

Lecture: 5

Quiz: 1

The Advanced Commercial Bank Management course delves into comprehensive aspects of overseeing a commercial bank. It delves deep into the fundamental banking concepts and financial institution management principles. This course provides students with the essential knowledge and competencies needed to effectively lead a thriving commercial bank.

Within this course, a wide array of topics are explored. These encompass the pivotal role of commercial banks in the economy, the core principles underpinning bank management, financial analysis techniques, prudent risk management strategies, effective loan portfolio oversight, and strategic planning methodologies. Furthermore, students will develop insights into the various integral departments within a commercial bank, encompassing operations, credit assessment, marketing strategies, and treasury functions.

-

Introduction to Commercial Banks

-

Understanding the Commercial Bank’s Regulatory Environment

-

Analysing Organisation and Structure of the Commercial Banking Industry

-

Measuring the Commercial Bank Performance

-

Recognising Bank Capital and Liabilities Management

-

Commercial Bank Management

Module: FINANCE FOR MANAGERS

Lecture: 12

Quiz: 1

This course aims to equip managers with a strong grasp of finance and accounting fundamentals, empowering them to make well-informed business choices and proficiently oversee financial assets. Key financial concepts, including budgeting, financial analysis, cash flow supervision, risk evaluation, and capital budgeting, will be comprehensively addressed. Participants will gain expertise in deciphering financial statements, scrutinizing financial information, and assessing potential investments.

-

Understanding cost system and its classification

-

Concepts and Tools of Cost Accounting

-

CASE STUDY - Activity based costing in Xu Ji Electric Co. Ltd

-

Understanding the Concept and Classification of Sources of Funds

-

CASE STUDY - Global Fund Raising Strategies

-

Understanding The Financial Performance Analysis

-

CASE STUDY - Financial Analysis Reporting

-

Understanding the Financial Ratios and its Various Types

-

Understanding The Budgetary Concepts and Approaches

-

CASE STUDY - How Maritz Accomplished a 40% IT Budget Reduction

-

Understanding the Working Capital Management

-

Understanding the Investment Appraisal Techniques

-

QUIZ - Strategic Financial Management

Module: BUSINESS ECONOMICS

Lecture: 5

Quiz: 1

The study of business economics centers on applying economic principles and concepts to inform decision-making within the business sphere. This discipline entails scrutinizing how businesses function, the choices they make, and their interactions within markets and the broader economic landscape. Business economics encompasses a diverse array of subjects, encompassing analyses of demand and supply, theories of production and cost, market dynamics, pricing tactics, risk mitigation, and financial evaluations.

-

The Macroeconomic Environment

-

Introduction to Managerial Economics & Demand Analysis and Estimation

-

Production and Cost Analysis & Estimation

-

The Market Structure & Game Theory

-

Pricing Practices and Market Failure

-

QUIZ- Economics for Business Management

Module: STRATEGIC MANAGEMENT

Lecture: 18

Quiz: 1

This course centers on the study of strategic management, emphasizing the creation and execution of strategies that enable organizations to attain their desired goals and objectives. It encompasses the complete strategic management process, starting with an examination of both internal and external environments and concluding with the execution of the selected strategy.

-

CASE STUDY - Strategic Management Approach by TESCO

-

Analysing Business Environment and its Impact on Strategic Decision Making

-

Understanding the External Business Environment Dynamics

-

Understanding The Internal Business Environment Dynamics

-

CASE STUDY - Staying ahead in a competitive environment

-

CASE STUDY - McDonald's strategic partnership for innovation as competitive advantage

-

Understanding Market Situational Analysis and Organisational Position Measurement

-

Analysing The Effects Of Exiting Plans On Organisation

-

Understanding Mandatory Competency & Competitive Advantage of An Organisation

-

Understanding The Relationship Between Corporate, Business & Operational Strategies

-

Understanding Strategic Models & Tools

-

Analysing and deciding on the strategic options

-

Developing Appropriate Vision, Mission & Strategic Goals For An Organisation

-

Developing An Agreed Strategy Plan For New Action Plan

-

Proposing an Effective Structure For Building Efficient Relationships With Stakeholders

-

CASE STUDY - Ethics and CSR at Honda

-

Understanding organisational strategic change management

-

Implementing Strategic Plan

-

QUIZ - Strategic Management

Module: INTERNATIONAL BANKING REGULATIONS

Lecture: 5

Quiz: 1

The course on international banking regulations is designed to provide an in-depth understanding of the regulatory environment in which banks and other financial institutions operate in today's global economy.

-

Understanding International Banking - Nature and Scope

-

Principles and Frameworks for International Banking Supervisions and Compliances

-

Risks and Challenges in Global Banking Regulations

-

Supervisory Structure of the International Banking Institutions and Markets

-

Exploring the International Banking Regulations and Supervisions and Financial Stability

-

QUIZ-International Banking Regulations and Supervision

Module: RESEARCH METHODS

Lecture: 14

Quiz: 1

The research methods course has been designed to offer students a comprehensive grasp of the research process, equipping them with the essential skills for effective research. It encompasses fundamental concepts and principles in research, encompassing the identification of research issues, research design, data gathering, analysis, and interpretation. This course delves into various research methodologies, encompassing qualitative, quantitative, and mixed methods research. Students will gain proficiency in crafting research inquiries and hypotheses, planning research endeavors, selecting suitable data collection approaches, and employing statistical software for data analysis. Furthermore, ethical aspects of research, including safeguarding human participants and the responsible practice of research, will be addressed. Throughout the course, students will gain familiarity with diverse research tools, including techniques for literature review, citation management software, and composing research proposals.

-

Research Philosophies and Principles

-

VIDEO - Overview of the Research Onion

-

Selecting a Research Topic

-

Searching and Reviewing Literature

-

VIDEO - How to write a Literature Review

-

Developing conceptual Framework

-

PDF - How to create a Conceptual Framework

-

Research Strategy and Design

-

Research Methods I

-

Research Methods II

-

PDF - How Observation is Used As a Research Method

-

Research Methods: Data Analysis

-

Research Proposal and Writing Up

-

Research Ethics

-

QUIZ - RESEARCH METHODS

Accreditation

All of our courses are accredited by the relevant partners and awarding bodies. Please refer to our information in about us for more details.

Entry requirement

For entry onto theInternational Postgraduate Diploma (IPGD) in Banking and Finance qualification, learners must possess the following:

- An honours degree in a related subject or the UK level 6 diploma or equivalent overseas qualification, i.e. bachelor's Degree or Higher National Diploma

OR

- Mature learners (over 25) with at least five years of management experience if they do not possess the above qualification (this is reviewed on a case-by-case basis)

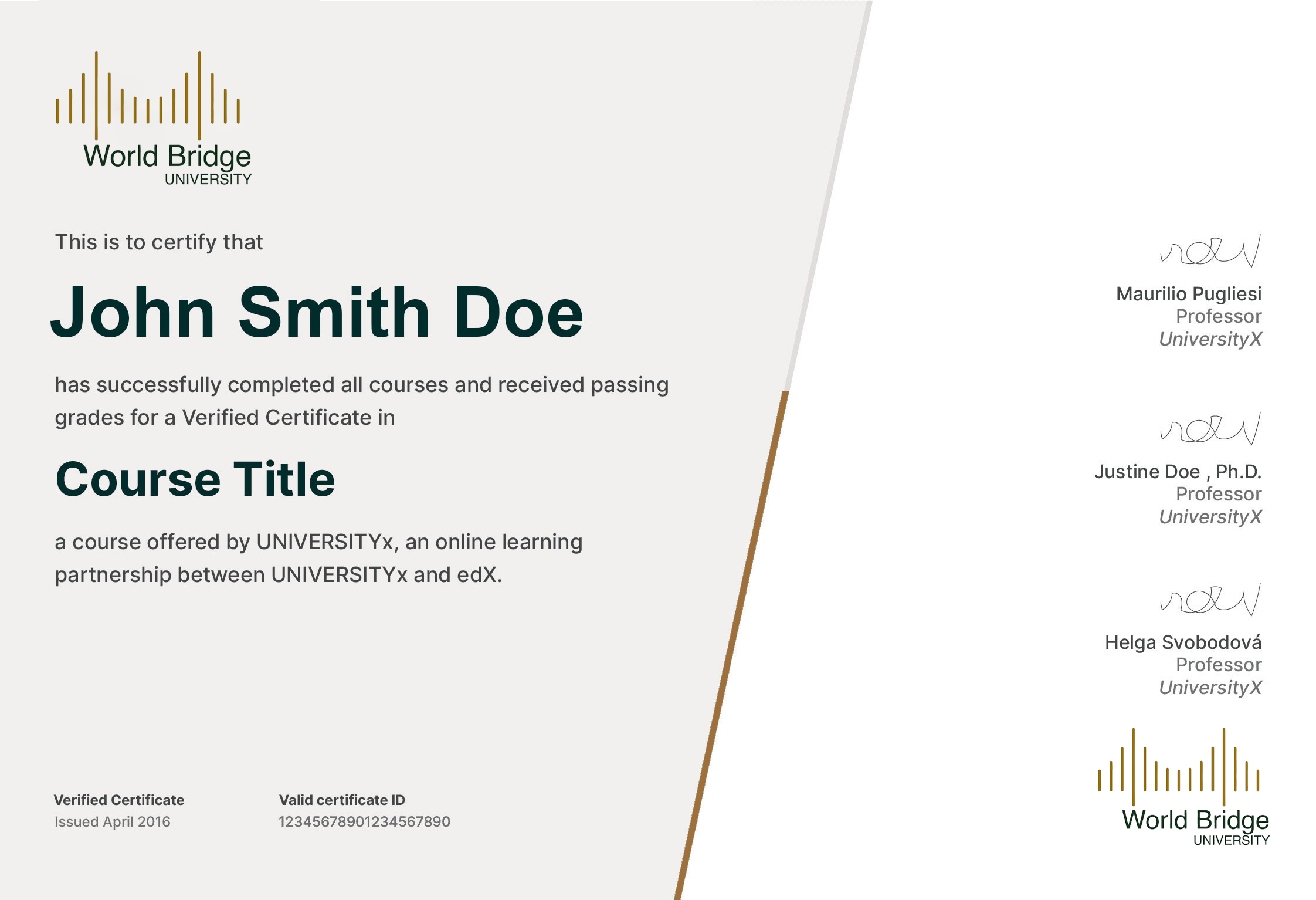

Sample Certificate

Request follow-up

Fill in the form below and one of our student advisers will contact you soon.

How students similar to yourself are reaching their aspirations.

At World Bridge University, our students don’t just gain skills; they grow in empathy, connect across cultures, and shape a future grounded in inclusivity and collaboration.

Kim A.

Ghana

These short courses have been a game-changer for my career. The knowledge and skills I gained here helped me secure a promotion and a substantial pay raise. I'm grateful for the opportunity to learn from experts in the field.

Advanced Professional Certificate Courses

Hollie W.

Kenya

I can't recommend these courses enough! The content is well-structured, and the instructors are top-notch. I completed a course in project management, and it immediately boosted my confidence and job prospects.

Advanced Professional Certificate Courses

Omar A.

Pakistan

I was pleasantly surprised by how practical and hands-on the courses were. The skills I acquired here are directly applicable to my daily work, and I've become a more valuable asset to my company.

Professional Certificate Courses

Austin K.

Sweden

I initially had reservations about online learning, but these short courses completely changed my mind. The platform is user-friendly, and the support from the instructors is outstanding.

Professional Certificate Courses

Huzaifa A.

United Arab Emirates

These courses are a fantastic investment in your professional growth. The price is reasonable, and the knowledge gained is priceless. I now feel more confident and competitive in my industry.

Advanced Professional Certificate Courses

Jolene P.

United Kingdom

The selection of courses on this website is impressive. I've completed multiple courses, and they've all been incredibly enriching. I'm grateful for the opportunity to learn and grow.

Advanced Professional Certificate Courses